Get in touch

-

Property & land search

Are you looking for a home?

Visit our Residential website

Biodiversity Units

Search for available Biodiversity Units listed for sale

-

Services

Our Projects

A track record to be proud of

Our People

Meet our team of dedicated, skilled professionals

-

Insights & Reports

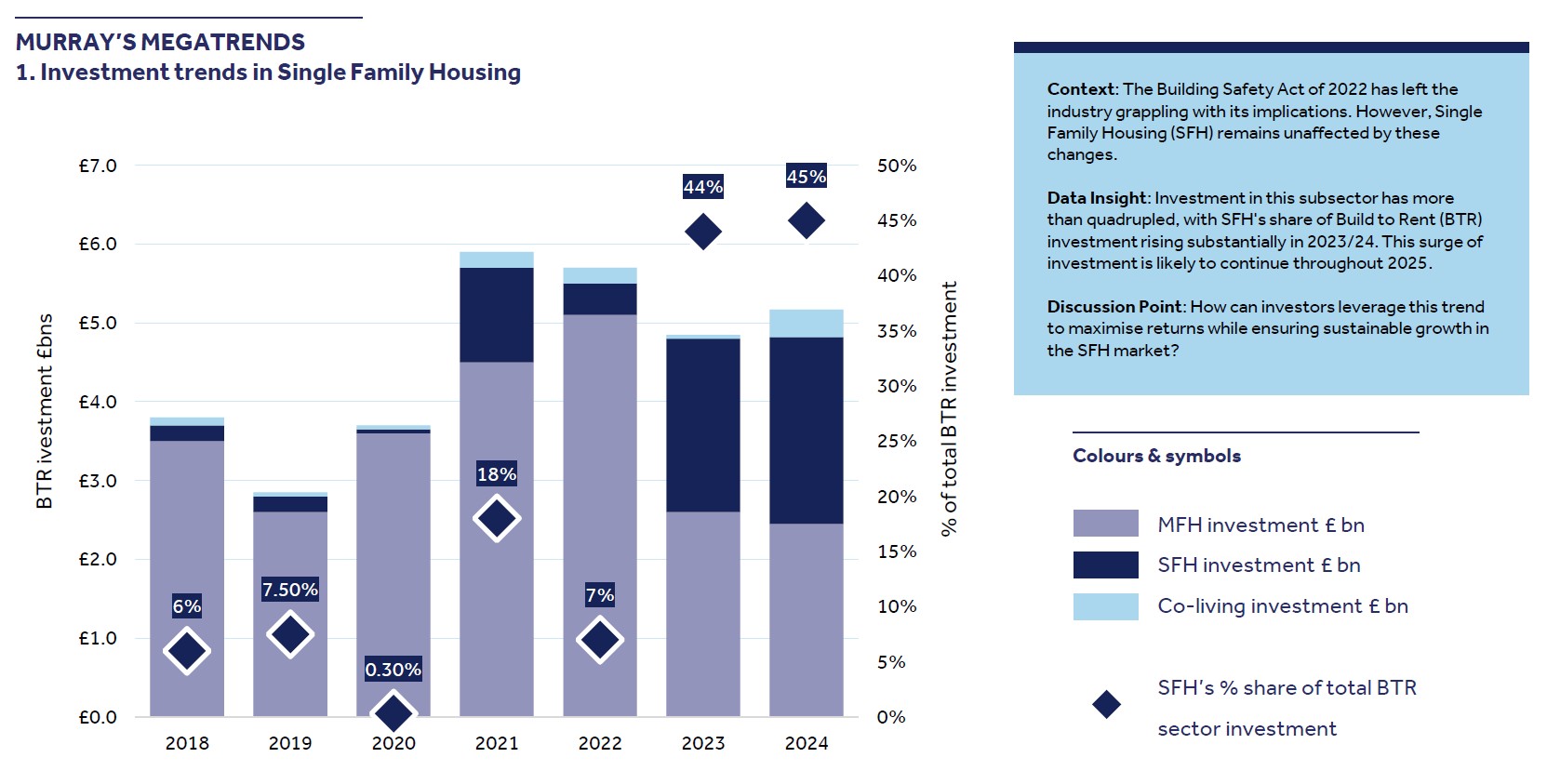

Investment for Growth

New research series exploring the forces shaping the future of UK real estate

Market Databooks

Key trends in office, laboratory and industrial

-

Our People

Looking to work with us?

Be part of better

Our offices

Locations across the UK

-

About us

Our Projects

A track record to be proud of

Recent news

Read all the latest news from Bidwells